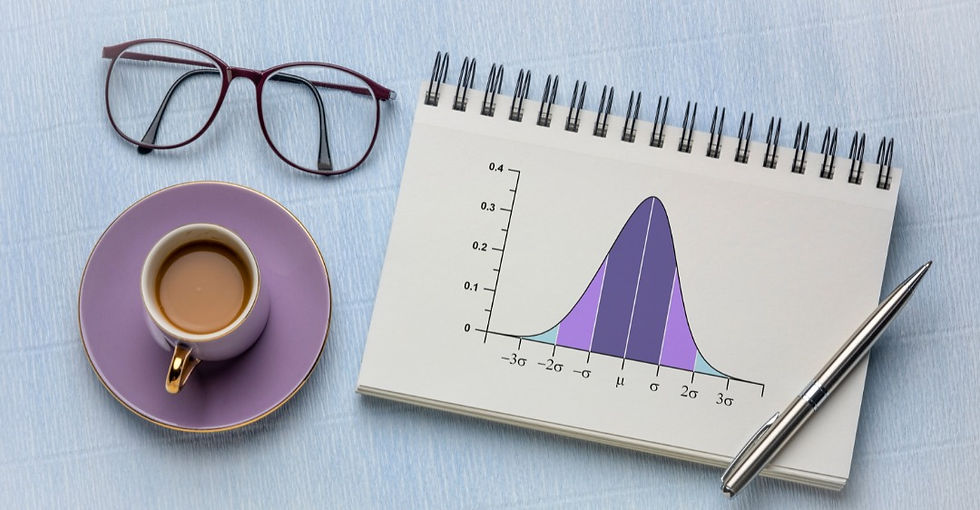

In finance, a confidence interval (CI) is a statistical method used to estimate the range that a specific unknown population parameter, like the average return of an investment, is likely to fall within, with a certain level of confidence.

Here's a breakdown of the key points:

Estimates a range: It provides a high and low boundary, indicating a plausible range where the true value might lie.

Uncertainty: It acknowledges the inherent uncertainty involved in using samples to estimate population parameters.

Confidence level: This is a percentage (commonly 90%, 95%, or 99%) that represents the likelihood of the true value falling within the calculated interval.

For instance, if you have a 95% confidence interval for the expected return of a stock, and it ranges from 5% to 8%, you can be 95% confident that the actual average return will fall somewhere between 5% and 8%.

Here are some key applications of CIs in finance:

Risk assessment: Evaluating the potential range of returns or losses for an investment.

Market analysis: Estimating the range within which future market prices might fall.

Portfolio management: Assessing the potential risk and return characteristics of a portfolio.

It's important to remember that CIs don't guarantee the true value will fall within the specified range. They simply provide a statistically informed probability statement based on the available data and chosen confidence level.

Imagine you're planning a budget for your dream solo trip to Bali. You research average flight costs, accommodation rates, and activity prices. But how sure can you be about these numbers? That's where a CI comes in. It's like a statistical superpower, telling you the range within which the true value is likely to fall, with a certain level of confidence.

Think of it like this: Your research suggests flights average $1,000, but with a 95% CI of $800-$1,200. This means you're 95% confident the actual cost will be within that range. So, while you can't predict the exact price, you have a data-driven framework to guide your planning and avoid nasty surprises.

Example: Let's say you're negotiating a raise. You research your industry's average salary for your position, finding it's $75,000. With a 90% CI of $70,000-$80,000, you know you have strong data to support your worth and negotiate confidently. You can point out the average and your CI, demonstrating your research and professionalism, increasing your chances of success.

Remember: CIs are powerful tools for navigating financial uncertainty. By understanding them, you can make informed decisions, negotiate effectively, and take control of your financial future.

.png)